By: Kymberly Amara

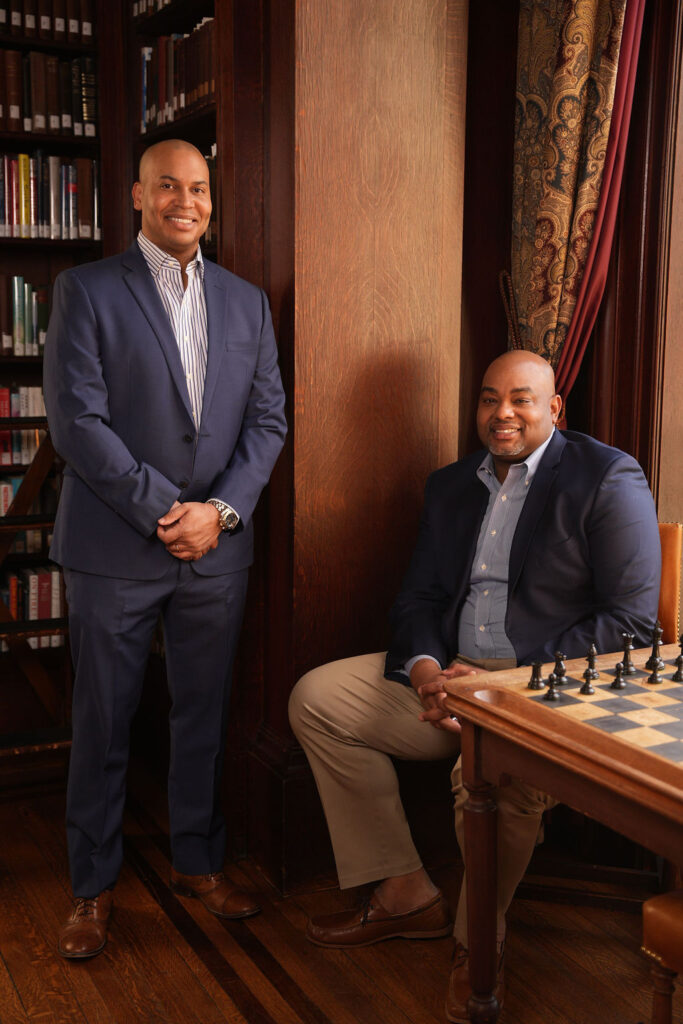

When discussing venture capital, investing, and luxury, one rarely pictures Black men at the helm. However, at East Chop Capital, co-founders Carrington M. Carter and Calvin L. Butts are not only driving the ship but steering it towards infinite success. Heart & Soul had the privilege to speak with the two about luxury real estate, goals, and what’s next for the private equity firm.

Having navigated the tumultuous recession that saw many young adults lose their jobs or limit them in their career search, both men were fortunate to take advantage of the discounted real estate available. After meeting each other at a Hampton University alumni conference, Carter and Butts, who had already experienced personal success in real estate, were looking to do more in the space and decided to work together. Before launching their private equity firm in 2018, they began posting and sharing their story, and people started reaching out to the two to offer help and support. Eventually, they decided to scale as the demand increased, and with the help of peers, family, and friends, they were able to raise $4 million for their first fund to start buying real estate.

The pursuit of entrepreneurship and getting into real estate

Butts: I graduated in 2002 and got into the pharmaceutical marketing and advertising space, working for large and small companies. I launched my first endeavor in 2008 due to my previous relationships at my other companies, where I was close enough to the CEOs and owners of the company. And quite frankly, I admired their lifestyles, and I assumed they were living that way because they owned the business. That was my first exposure to ownership. I grew up well-off, my father was a physician, so I understood entrepreneurs from a healthcare perspective but not from other industries. Having the chance to get to know these CEOs, mentors, and sponsors and be invited to their homes to hang out with them at their country clubs and travel with them made me realize that ownership was a path to obtaining a particular lifestyle that I admired and wanted to obtain for myself. I was motivated and inspired by them to launch a series of companies that have done well in the healthcare and advertising space. From there, I asked my mentors and sponsors questions about what they were doing with their income and their capital, and a lot of them talked about real estate, the stock market, and investing in other businesses. I began following the waves they were making, researching, and buying single-family homes in West Philadelphia. When I met Carrington, we decided to pivot into the vacation rental home space.

Carter: My first introduction to thinking about money differently was reading Rich Dad, Poor Dad freshman year at Hampton University and learning the concept of having your money work for you instead of working for your money. After grad school, I started my corporate career in the summer of 2008. By fall 2008, the economy started softening, and by spring 2009, we were in a full-blown recession. I saw a lot of people lose their jobs or couldn’t get jobs. I thought I was going to lose my job, and it was sort of a wake-up moment, and I realized I needed more control of my future, and I realized you couldn’t have that when you are focused on working a nine to five; you don’t have as much control over your destiny. I [began] thinking about what kind of businesses I could get involved in that required capital but didn’t necessarily require any active day-to-day management, and that’s how I got into real estate. Like Calvin, I started buying single-family rental homes and then expanded to vacation rental homes after taking a ski trip in the Poconos. Myself and friends would go skiing every President’s Day weekend in the Pocono Mountains in Pennsylvania, and when it came time for me to plan the trip, I found a house, worked with the owner, and I realized how much we were paying him to stay in his house for the weekend. So, I started running the numbers and saw the financial viability of the vacation rental home space.

Both men were fortunate enough to have landed six-figure incomes, which made the timing ideal for those with the mindset and know-how to take advantage of the wealth transfer occurring during that time, especially in real estate. But, being financially stable doesn’t necessarily translate into having business acumen or the mindset that coincides; this must be developed over time.

Knowing when to take advantage of opportunities when they arise

Carter: Part of it [taking advantage of opportunities] is having goals and establishing where you want to go. I saw real estate and investing as a way to get me where I wanted to go. From a mindset standpoint, I read a lot and study a lot of great investors and great business minds. As it relates to the recession, a quote by Warren Buffett comes to mind, “Be greedy when others are fearful and fearful when others are greedy.” Anytime people are scared, I’m out there looking for opportunities, and that’s where a lot of those opportunities were during the recession. We built a lot of initial wealth that way, buying houses in neighborhoods that we were familiar with because we knew it was only a matter of time before the values would rebound. Also, being a student of business and some of the great business and investing minds and understanding markets, timing, and cycles helped us act during the recession, overcome fear, and take calculated risks.

Butts: For me, it was all about exposure. I was blessed enough to be around some of my father’s network and friends and my internship right out of college; this is where most of my drive and ambition in business came from. I was an intern at the Savannah Chamber of Commerce, and I had a chance to sit in on the board meetings. Around the table, there were college presidents, the guy who owned the local car dealership, the president of the local college, and various business leaders like the mayor and the city manager. I got a chance to see how they operate and how they mapped out and executed the vision of one of the South’s fastest-growing cities in Savannah, Georgia, and that was important for me to see. I got a chance to see that relationships are important and that networking is vital. These guys knew each other, and their families were connected. They lived in the same communities and were mapping out and designing where the next mall would go and how to expand the airport; all of these things were connected to their business. At that point, I knew that relationships were very important and that partnerships matter. That exposure drove me to create great relationships and seek out partnerships.

Carter and Butts desire to expose and educate our communities to generate and build wealth. The duo has also amassed an impressive real-estate portfolio with $20 million in assets under management in just a short time. They recently raised $9 million for their second real estate fund, which is more than double the size of the first fund.

On building a lucrative portfolio and focusing on Black enclaves

Carter: For anybody raising money, it’s difficult whether you’re Black or White. We thought it should’ve been easier, and it should be easier because we are experienced businessmen, we’re experienced entrepreneurs, and successful in our own right. What there needs to be more of in our community because there certainly is in the White community; there needs to be more I believe in you money. I see your potential, you have an idea, I see your track record, and I want to support you now and continue to support you to get to the next level. There’s not enough of that, I believe in you money that exists in our community. Part of it is because of the wealth gap, we simply don’t have it, and the other part is because we are scared to make those investments, and we’d rather do something different. There are many reasons, but for these households that are two to five hundred thousand dollar households, it needs to become a part of our culture. Those individuals who have the money need to be sowing seeds of I believe in you money, especially in women and minority entrepreneurs.

Butts: It [The Poconos] was an obvious first choice because he [Carter] was fresh off the trip, and we were looking and talking to the owner of the house, and we were able to get that deal put together quickly. The second location I happened to stumble upon in Martha’s Vineyard. I was at a Grand Boule conference, and everyone was headed over to the island for summer vacation. I was unaware that everyone wanted to be there, needed to be there, and was excited to go there during those first couple of weeks in August. I was invited over and fell in love with the place after seeing the community and the power of the place for networking and events. We went and looked at homes that same trip. Carrington and I moved pretty quickly on our second purchase, our Pirates Cove home on Martha’s Vineyard. We started thinking about Black enclaves and other places that had a history of the Black community or that could be gathering spaces for us. That’s where Hilton Head came on board as well as us creating new places and new enclaves for us to travel and connect.

Perhaps most intriguing is the pair’s commitment to ensuring that others have access, information, and exposure to create and maintain wealth. They have made it a point to share, expose, educate, and teach others what’s possible.

Educating our communities through exposure

Carter: Our commitment with East Chop Capital is to provide the best combined financial, educational, and social returns. Core to our commitment is our educational returns to educate our 150 LPs (limited partners). This diverse group comprises 90% BIPOC, 10% White, and 17% women investors. We educate our investors on real estate and vacation rental homes and analyze private equity and venture capital investments. Part of the importance of being in this space is we can educate others to show and teach them different possibilities. As it relates to wealth, wealth is built through the ownership of assets…and that’s why it’s important for us to own assets…We discovered a higher-order purpose throughout this process of raising money through East Chop Capital which gave us the drive and the vision to make this much larger than real-estate and vacation rental homes.

Butts: Our motto is to have the best combined financial, educational, and social returns. The educational returns are held at our investment retreats. We bring our investors together to learn from us, learn from each other, and share their experiences. We are out here planting seeds in other individuals who look like us, and even strangers, so we can learn and share the different opportunities and deal flow that’s out there. We have an open-door policy with our investors; they have invited their children to our cause, and they’ve invited their neighbors and network to our events to expose others to some of the work that we’re doing. We would love to see our community catch up as best and fast as possible. To do that, we will have to share and be open to sitting down at the table and walking others through what is possible, what they are capable of doing, and financial literacy of understanding your status.

The future of East Chop Capital

Carter: We have future aspirations to make this a premier private equity firm with hundreds of millions, if not billions of dollars in assets under management. Our focus and foundation have been real-estate and vacation rental homes, and as more deals come our way, our investors are interested in participating in different deals. One way we are going to do it is through a fund of funds where we will raise money from our existing investor base and maybe put it out there to our new investors. Once we raise that money, we will invest in other fund managers who select companies to invest in, or we may make some direct investments.

Butts: We recently put together a group that put together $1.6 million behind Uncle Nearest and Fawn Weaver. We are happy to be investors in that group. We are also continuing to pass the ball, and we’re looking for leaders in other industries and different spaces to get behind and support. That’s everyone, from our fellow Antonians who are doing some unique things in the private equity space to other individuals who have gone on to launch venture capital and funds. It’s pretty exciting.

Despite the wealth gap and many obstacles facing our communities in this country, the HBCU grads have taken on the challenge facing underserved communities and met it with ambition and tenacity. Their efforts have resulted in them raising money for their funds, scaling the organization, and educating others on building and maintaining wealthy societies for generations to come, one Getaway at a time.